Wall Street has seen a broad-based decline in 2022 with the technology sector suffering the most. The technology sector, which enabled Wall Street to get rid of the coronavirus-induced short bear market and formed the new bull market, has suffered since the beginning of this year as most market participants were extremely concerned about the sector’s overvaluation in the last two years .

Consequently, the tech-heavy Nasdaq Composite has suffered the most as the index has plunged 28.6%. US stock markets are likely to face hardships in 2023 as the Fed raised its terminal interest rate in this rate hike cycle to 5.1% in December from 4.6% in September.

This means that the central bank will raise interest rates by at least 75 basis points in 2023 from the 2022 range of 4.25-4.5%. No rate cut will take place before 2024. A large section of economists and financial experts are worried about a recession next year.

Consequently, the Nasdaq Composite may continue to bleed in 2023. However, we have identified five non-technology stocks from this stable that have popped in 2022 despite the index’s blood bath. Currently, these stocks carry a favorable Zacks Rank and have more upside left in 2023. These companies are:

LPL Financial Holdings Inc. (LPLA – Free Report) has been benefiting from strategic acquisitions, including the buyout of Waddell & Reed’s wealth management business. Solid advisor productivity and recruiting efforts are expected to keep helping the advisory revenues of LPLA. Moreover, LPL Financial’s efficient capital deployment activities reflect a solid balance sheet position.

LPL Financial has an expected earnings growth rate of 72.8% for next year. The Zacks Consensus Estimate for next-year earnings has improved 6.9% over the last 60 days. The stock price of LPLA has climbed 34% year to date. The stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Enphase Energy Inc. (ENPH – Free Report) has revolutionized the solar industry by pioneering a semiconductor-based microinverter, which converts energy at the individual solar module level. ENPH enjoys a strong position as a leading US manufacturer of microinverters.

Enphase Energy is striving to expand in Europe steadily throughout 2022. Such expansion plans may boost its long-term growth in the battery storage market. ENPH has also been making acquisitions to boost its long-term growth. It holds a strong solvency position.

Zacks Rank #2 (Buy) Enphase Energy has an expected earnings growth rate of 25.8% for next year. The Zacks Consensus Estimate for next-year earnings has improved 2.4% over the last 30 days. The stock price of ENPH has soared 81.9% year to date.

United Therapeutics Corp. (UTHR – Free Report) is witnessing strong demand for treprostinil medicines, Remodulin, Tyvaso and Orenitram despite generic concerns and competitive pressure. UTHR’s newly-launched expanded indications for Orenitram and Tyvaso and pipeline can potentially drive long-term growth. United Therapeutics is progressing fast towards its goal of 6,000 patients on Tyvaso therapy by 2022.

UTHR also aims to expand Tyvaso in IPF indication as management believes that sales in PAH indication have reached their peak. United Therapeutics is engaged in R&D efforts to expand the supply of transplantable organs.

Zacks Rank #2 UTHR has an expected earnings growth rate of 12.5% for next year. The Zacks Consensus Estimate for next-year earnings has improved 0.1% over the last 30 days. The stock price of United Therapeutics has surged 28.1% year to date.

ShockWave Medical Inc. (SWAV – Free Report) is optimistic about the sustained clinical acceptance and penetration of Intravascular Lithotripsy (IVL), as evident from its strong demand in the first nine months of 2022. The results were driven by the increasing adoption of coronary IVL in the United States. The introduction of Shockwave C2, in the United States, and higher adoption of Shockwave products, are major positives for SWAV.

Zacks Rank #2 SWAV has an expected earnings growth rate of 21.2% for next year. The Zacks Consensus Estimate for next-year earnings has improved 3.2% over the last 60 days. The stock price of ShockWave Medical has advanced 23.7% year to date.

ChampionX Corp. (CHX – Free Report) provides chemistry solutions and engineered equipment and technologies to companies that drill for and produce oil and gas. CHX’s Chemical Technologies offering consists of chemistry solutions for flowing oil and gas wells as well as chemistry solutions used in drilling and completion activities.

CHX’s Production & Automation Technologies offerings consist of artificial lift equipment and solutions. Drilling Technologies offering provides polycrystalline diamond cutters and bearings.

Zacks Rank #2 ChampionX has an expected earnings growth rate of 46.3% for next year. The Zacks Consensus Estimate for next-year earnings has improved 4.7% over the last 30 days. The stock price of CHX has jumped 39.3% year to date.

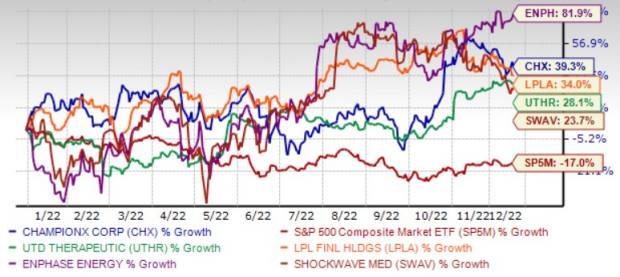

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

.