A trader works on the floor of the New York Stock Exchange (NYSE).

Getty Images

The market for high-growth technology companies went south this year as the economy turned and interest rates rose. The bubble valuations of 2020 and 2021 gave way to a bust as investors focused on how unprofitable companies would turn a buck.

But the washout may not have reached its end game yet, according to two top private equity investors.

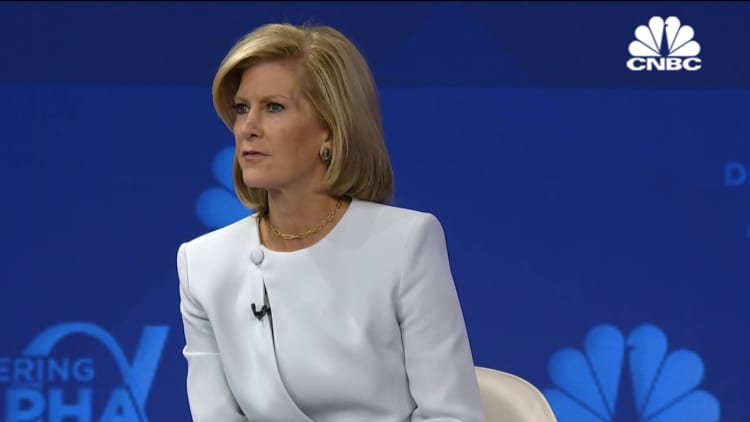

There was a sharp and “immediate value reduction from where the market was,” said Orlando Bravo, founder and managing partner of private equity firm Thoma Bravo, speaking at CNBC’s Delivering Alpha conference on Wednesday, but not all tech companies and investors are on the same page.

Some private sellers have not yet decided to accept the current valuation reset as valid and will attempt to wait out this market. For their part, many investors still aren’t sure if the valuation hits already taken are enough.

Global investors were happy buying growth regardless of economics when rates were zero, but “now they want profitability, so what’s a company worth that is growing at 30% and making no money?” Bravo said. “Is it 20x revenue or 3x revenue? There has been no bottom to that,” he said.

Bravo said tech firms can make a case that they can wait out the cycle and get a better valuation, but with an economy that is slowing down, their problems may only get worse if, on top of no profits, their revenue decelerates, too. “What happens in this environment if it decelerates every quarter?” Bravo said.

The fundamental shift in the public markets has taken place, with investors reconnecting to fundamentals and “getting in touch with what a sustainable growth rate of companies is,” said Bill Ford, CEO of growth equity firm General Atlantic, also speaking at DA. But that reset for companies that are growing without profits has not been fully translated to the private markets yet.

“It will take some time for entrepreneurs to accept that growth is priced differently, and we have a stalemate now,” Ford said of the reset forced by shrinking P/E ratios on the S&P 500. “We’re waiting for that,” Ford said. “It will clear itself in a few years,” he added.

IPO market could take years to recover

Ford cited the average IPO slumping 40% from last year’s level as a reason for private markets to correct more in the near-term, and an obstacle keeping companies from going public for longer than many expected. “It could be several years before the IPO market is constructive again,” Ford said. Investors need to be able to model long-term growth rates and profitability, and that could take a while, he added. And it’s not as if going public has worked well for many of the high-growth tech names.

“They have not gotten the benefit of going public,” he said, citing a lack of long-term shareholders staying with a company and an inability to raise additional capital.

Ford’s message to his own portfolio companies is to extend their runway for thinking about an exit, manage costs and key performance indicators on a path to long-term profitability. “Buy yourself time. That’s what we are preaching to all our portfolio companies,” he said. “Figure out what the growth drivers are, and invest in those areas, and expect a longer runway before you can go public,” he added.

Both private equity leaders see consolidation among tech companies as a precondition to going public in the future. “The public markets will want greater scale and some companies that went public last year had not achieved economies of scale,” Ford said. “We will get consolidation.”

There were too many companies in many of the new tech niches where investors backed public offerings in recent years, Ford says. Traditionally, markets will be winnowed down to two or three competitors before the winners become clear to investors, but in the past few years there were as many as eight companies going public in high-growth tech sectors. “We will need that consolidation given how many companies were created during this upcycle,” Ford said.

“For a portfolio company, it might be a terrible time to sell, but it’s an awesome time to consolidate. … and you might be better off in the long term,” Bravo said.

Ford said some of the companies that went public, are now trading at deep discounts, are now missing important growth numbers and are also no closer to attractive levels of profitability will go private.

Many of these companies have no access to capital to act as consolidators, Bravo added, and it will become increasingly difficult for them to motivate employees and show business strength to customers.

Cut back and protect the P&L

Both private equity executives are telling portfolio companies to make cuts.

“Our school of thought has always been protecting the profit and loss statement” Bravo said. “Live and die by it and never dip into margin unless you have a compelling investment you can measure separately.”

Layoffs in tech are unpleasant, but companies need to have discipline when it comes to matching labor and productivity. “There is some slowing in hiring and reorganizing of business and cutting at some of them until they see a runway,” Bravo said. “And when things pick up, you’re really ready to invest,” he added.

“It’s not cutting for cutting’s sake” Ford said. “Make the right investment decisions to fund long-term growth,” he said. “One of the things people lost sight of completely is long-term profitability. They had no idea of long-term operating margins. ‘Am I 10% or 15%?’ We are telling people to get focused on that and set up a much better value creation story down the road,” Ford added.

While the current market is tough, Bravo and Ford both see attractive long-term technology trends. Ford, who has more investments in business-to-consumer tech, cited the spread of 5G internet to 80% of the world by 2030, and investments being made in next generation semiconductor companies. “We know the Nvidias and Qualcomms, but we’re seeing in the venture space now new chip companies being developed and taking advantage of the shift out of China,” he said.

Bravo pointed to business-to-business cybersecurity. “When you look at the big pie of cyber, it has explosive growth, and there are so many threat vectors.”

.