Investors don’t want to “give up” on technology stocks, but other areas of the small-cap equities market look more attractive after the recent rebound in this year’s slump, according to analysts at Jefferies.

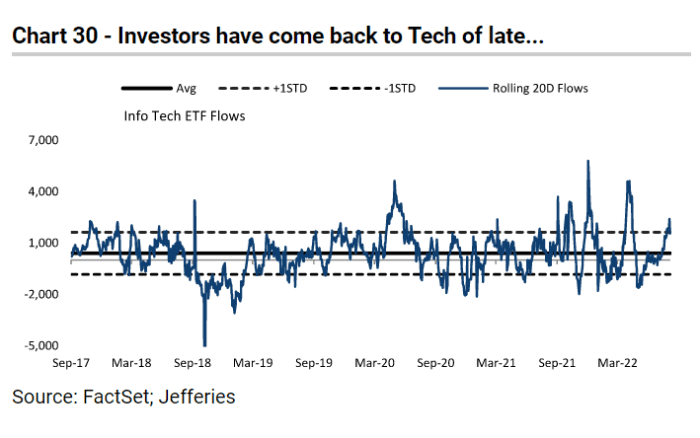

“When we talk to investors, it seems like they are heading right back into tech, and we see flows to its ETFs accelerate as well,” Jefferies analysts led by Steven DeSanctis said in an equity strategy note Wednesday, referring to exchange-traded funds focused on the sector. “We don’t think this makes sense.”

JEFFERIES NOTE DATED AUG. 24, 2022

Jefferies is “underweight” small-cap stocks in information technology, saying they remain “expensive” with their earnings and sales estimates falling, according to the note. The analysts said that current valuations at 3.4 times sales are not cheap compared to the long-term average of 2.1 times.

“Tech has gone from very expensive to just expensive,” they said. “We don’t think folks want to run the ’20 rebound playbook that has this group outperforming.”

The analysts said there are “too many nonearners” among small-cap tech stocks, which are “clearly in the cross-hairs” as they tend to perform “poorly” when the Federal Reserve is hiking interest rates. The Fed has been aggressively raising its benchmark rate this year in an effort to fight high inflation.

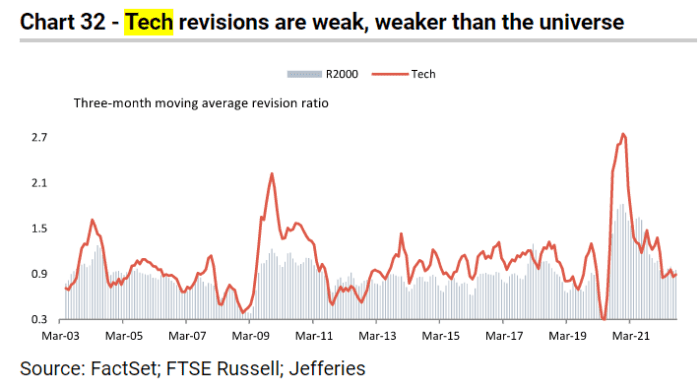

Meanwhile, earnings and sales estimates for 2022 are being trimmed for small-cap tech stocks, which have seen weaker revisions than the broader universe measured by the Russell 2000 Index, according to the report.

JEFFERIES NOTE DATED AUG. 24, 2022

The small-cap focused Russell 2000 RUT,

was up 0.7% Wednesday afternoon, paring its drop in 2022 to around 14%, according to FactSet data, at last check.

The benchmark is faring a bit worse than the S&P 500 Index SPX,

a gauge of large-cap stocks in the US, so far this year. The S&P 500’s has sunk around 13% in 2022 based on Wednesday afternoon trading that pushed the benchmark up 0.3%.

Read: ‘Uncomfortable’ with S&P 500 valuations? Investors may still find ‘bargains’ in small-cap stocks, says RBC

Within small-caps, Jefferies likes the healthcare and consumer-discretionary sectors, which the analysts said have outperformed. They have “risen from ashes,” driving the recent bounce in small-cap stocks, the analysts wrote. “We both stay overweight.”

Valuations in healthcare have not jumped as much as the sector’s performance, according to their note. “This group already priced in a nasty recession, down more than its average decline during a bear market,” the analysts wrote. Meanwhile, merger and acquisition activity has picked up in healthcare, which could help drive performance as “we are now moving to the period when deals accelerate,” they said.

As for discretionary, stocks in the sector are “by far the cheapest group in the size segment,” according to Jefferies.

“The sector fell way more than its average decline during a bear market, which we thought was overly harsh,” the analysts said. “The group tends to outperform coming out of bear markets.”

Meanwhile, investors seem to still want to own small-cap tech stocks, viewing the drop at the beginning of the year as a buying opportunity, the Jefferies analysts said. “We disagree and don’t think investors need to be aggressive in this sector.”

Don’t miss: Hear from Carl Icahn at the Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. The legendary trader will reveal his view on this year’s wild market ride.

US stocks were broadly trading higher Wednesday afternoon, with the Dow Jones Industrial Average DJIA,

edging up 0.1% and the technology-heavy Nasdaq Composite COMP,

rising 0.5%, according to FactSet data, at last check.

.