ONE of the leading rural banking institutions in the Philippines has launched an innovative new mobile banking app for Android and iOS designed to transform its customers’ experience.

The app from Agribusiness Rural Bank Inc. (Agribank) has been developed and delivered by digital banking software provider Geniusto. Secure and configurable, the app enables Agribank to publish new services and product offerings in real time. This upgraded capability would ensure Agribank’s customers could bank seamlessly and with more efficiency than ever before.

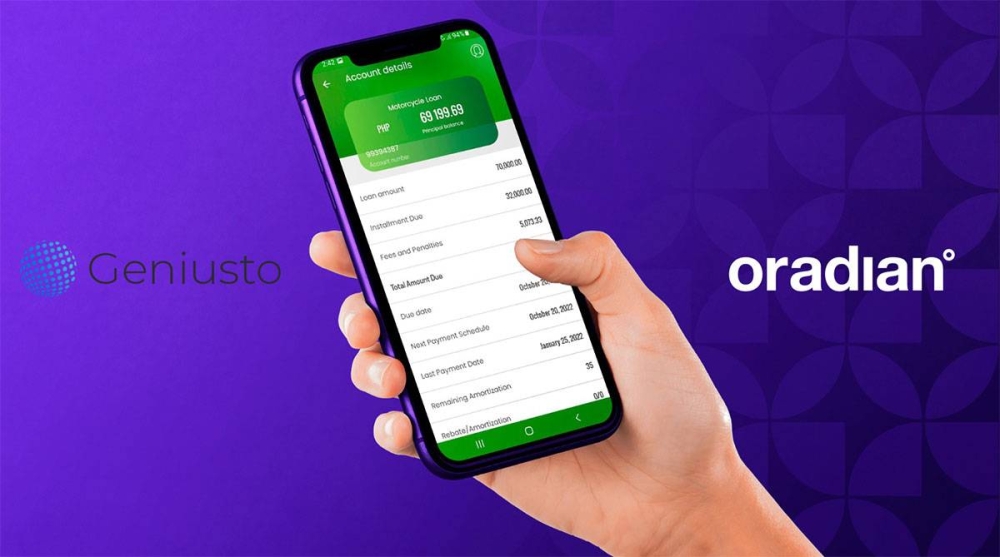

Agribusiness Rural Bank Inc. mobile banking app is enabled by Oradian’s advanced cloud-based core banking system. CONTRIBUTED PHOTO

Enabling Geniusto to deliver mobile banking services to Agribank’s clients is Oradian’s advanced cloud-based core banking system. Oradian’s flexible and extensible banking system uses APIs to power third-party integrations, allowing Agribank to rapidly add new features or launch new products.

As a result of this collaboration between Agribank, Geniusto and Oradian, Agribank is now better placed to digitally transform and better serve rural communities across the Philippines.

“Exciting times lie ahead for Agribank indeed as we embark on our digital transformation journey,” said Danny Boy Antonio, president and CEO at Agribank. “Agribank dedicates its efforts to ensuring that every Filipino is given access to formal banking facilities and equipped with the necessary knowledge and information. Empowering them with a secure and reliable online banking platform is one of our magnificent leaps toward financial inclusivity. (We will bring services for urban areas to rural areas!) Agribank is making every effort to uphold its corporate tag as “your rural bank that cares.”

“At the center of all our efforts to improve our banking services lies our kababayan as we commit to serving the rural and underbanked communities by bringing them the next-generation banking experience,” said Antonio.

“By empowering both the rural banks and their customers with mobile banking, we allow the small institutions to remain relevant within their communities and to compete with the huge uni-banks and alternative financial services operators that have been eroding the rural bank’s traditional role,” said Matthew Edmunds, chief executive at Geniusto.

“Small institutions could now provide a Geniusto secure mobile banking application for their customers that quite frankly is, in many cases, more advanced and secure than the competition from the uni-banks. The institution could build loyalty with their customers and provide an array of relevant services including loan originations, bills payment, and QR code payments within the community. The institution could now remotely onboard new customers, growing their customer base and ensuring long-term growth and stability for the business,” Edmunds added.

“Oradian’s core banking system is designed for connectivity and integration. Our goal is to be the driving force for financial institutions to deliver their services to customers, to provide them with vital access to financing, credit, and banking services,” said Antonio Separovic, co-founder and chief executive.

“We’re delighted our partnership with Geniusto has enabled it to develop a transformative mobile banking application for Agribank, so it could continue to deliver innovative financial services to its end users. We’re certain this would further accelerate Agribank’s already impressive growth and provide exciting and accessible experiences for its clients,” Separovic said.

.