hobo_018/E+ via Getty Images

Thesis

Goldman Sachs Future Tech Leaders Equity ETF (NYSEARCA:GTEK) is an exchange-traded fund (“ETF”) focused on high growth-technology equities. The fund is new, having been started at the end of 2021, and marking on its way to a top in technology stock valuations. That is usually how a market top is identified – a plethora of new funds and products that hammer in the same theme proven to be very successful in the preceding years. The fund has had an uneasy 2022, being down more than -38%.

After the Fed announced their decision to raise rates yesterday and communicated their guidance, the market rallied, led by technology. A new investor might not find this intuitive, since rising rates should usually lead to lower valuations for long-duration technology stocks. This was not the case on July 27, when investors instead chose to focus on the Fed-speak that gave them the impression that rate cuts are coming at some point next year. The idea is that the Fed is committed to frontloading all of the rate hikes this year, which will drive the economy into a recession (today’s negative GDP print for Q2 indicates that we are technically in a recession as we speak), which in turn will result in lower rates down the line. Lower rates mean higher valuations for tech stocks, so time to buy now, the market is forward-looking anyway, right? We are of a different opinion.

We are of the opinion that rates will stay higher for longer this time around and that the Fed is committed to seeing inflation figures come down substantially before lowering rates, even with the price of a mild recession. As mentioned above, we are technically in a recession as we speak, with two quarters of contracting GDP figures. However, the labor market is strong, consumer balance sheets are in good shape, and the political apparatus is quick to point out that it is not really a recession when “Help Wanted” signs abound.

Structural inflation hurts long-term growth, and the Fed knows it. It will not be enough for inflation to moderate for the Fed to cut rates – inflation will need to come down substantially and consistently for rates to be cut. We do not think this will happen in the next few months as the market anticipates.

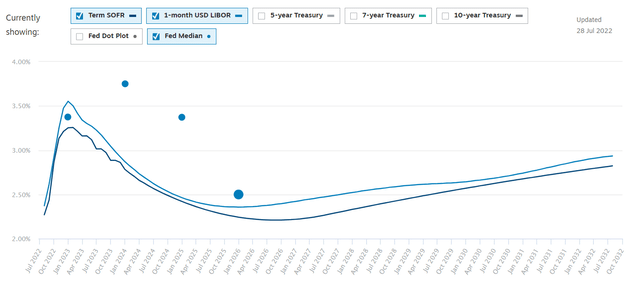

Currently, the forward SOFR and Libor curves look like this:

Curves (Chatham)

We can see that the market is currently pricing peak Fed Funds rates at the end of 2022 with a gradual rate decrease in 2023. The graph, courtesy of Chatham, also plots the Fed median rate dots, however unreliable we might find them.

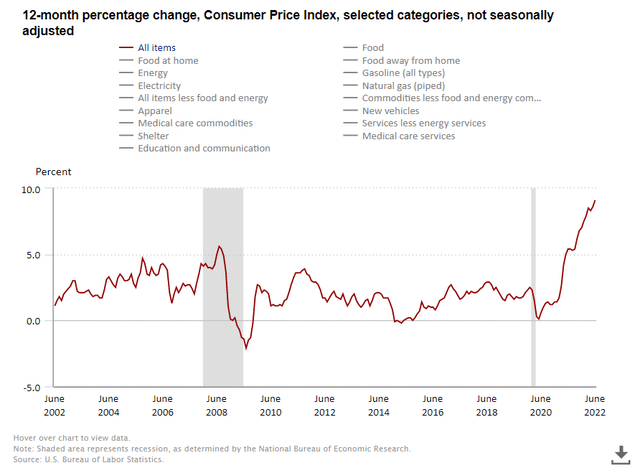

The main inflation metric, the CPI, is currently running above 9%:

CPI Metrics (Govt.)

And while the core Personal Consumption Expenditures Price Index (“PCE”) is decelerating, it needs to still come down substantially. Please note that core PCE excludes energy and food, the most volatile inflation components. Also, a decelerating PCE means that the number is still going up, just at a lower rate than before. Going back to our CPI graph, we can notice that the only other time in the past decade when CPI was above 5%, it took an entire year for that figure to flatten out by five percentage points and that was during the Great Financial Crisis of 2008/2009! Just layering in the same logic and time frame, we can infer that in a very aggressive scenario, the CPI will be at 5% next August at the earliest. Yet the market is seeing Fed rate cuts as early as Q1 2023. Something does not gel in our opinion here.

We feel the market is erroneous, is clamoring for the same trade as in the past years – namely, long technology stocks on the back of structurally low rates. We feel, this time around, inflation will prove much more sticky than expected, and higher rates will linger for much longer versus market expectations. We, therefore, think it is extremely premature to consider jumping back into GTEK, a name best revisited in Q1 2023 when inflation expectations and Fed policies will be much clearer long term.

Holdings

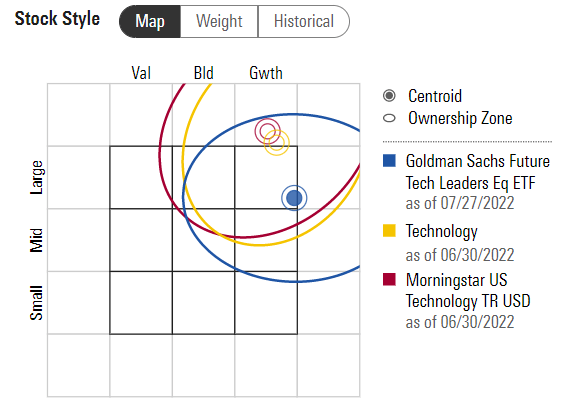

The fund falls in the Mid/Large Cap Growth box as per Morningstar:

Style (Morningstar)

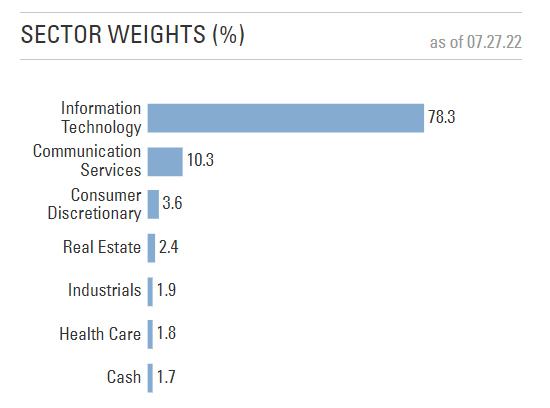

The fund is overweight information technology names:

Sector Weights (Fund Fact Sheet)

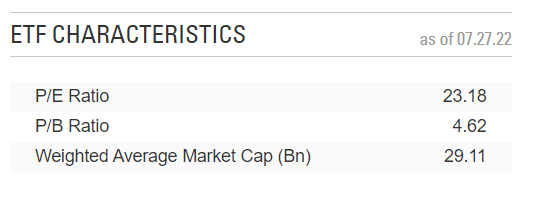

The underlying equities still expose very high P/E ratios:

Characteristics (Fund Fact Sheet)

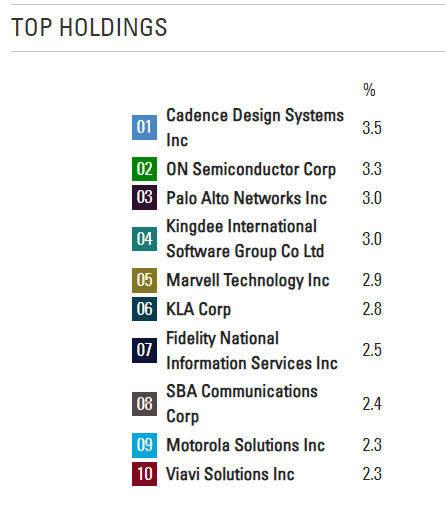

The top names in the fund are not your household Large Cap tech names:

Top Holdings (Fund Fact Sheet)

Performance

The fund is down more than -38% this year, significantly “outperforming” Technology Select Sector SPDR ETF (XLK) to the downside:

YTD Performance (Seeking Alpha)

The vehicle is down more than -40% since inception, being a good advisory to investors who buy at the top of a certain market theme:

Since Issuance Performance (Seeking Alpha)

Conclusion

Being long technology stocks has proven to be a significantly profitable trade in the past decade. Fueled by low rates and ample liquidity, the trade brought capital to tech enterprises across the capitalization spectrum. Goldman Sachs Future Tech Leaders ETF is an exchange-traded fund focused on high-growth technology equities. Launched at the end of 2021, the fund proved to be a high mark of tech companies’ valuations. Down more than -38% this year, the vehicle is experiencing a significant drawdown. After the Fed announced their decision to raise rates on July 27 the market rallied led by technology, with GTEK up more than 2% on the day. We do not think that tech will experience a V-shaped recovery, and we strongly believe higher rates are here to stay for longer. In our view, jumping back into tech at this stage is not a trade to pursue.