2022 has already surpassed the previous three years in Alberta venture funding.

Following a record-setting second quarter, venture funding in Alberta fell in line with the downward trend seen across most Canadian ecosystems in the third quarter of 2022, according to a new report from briefed.in.

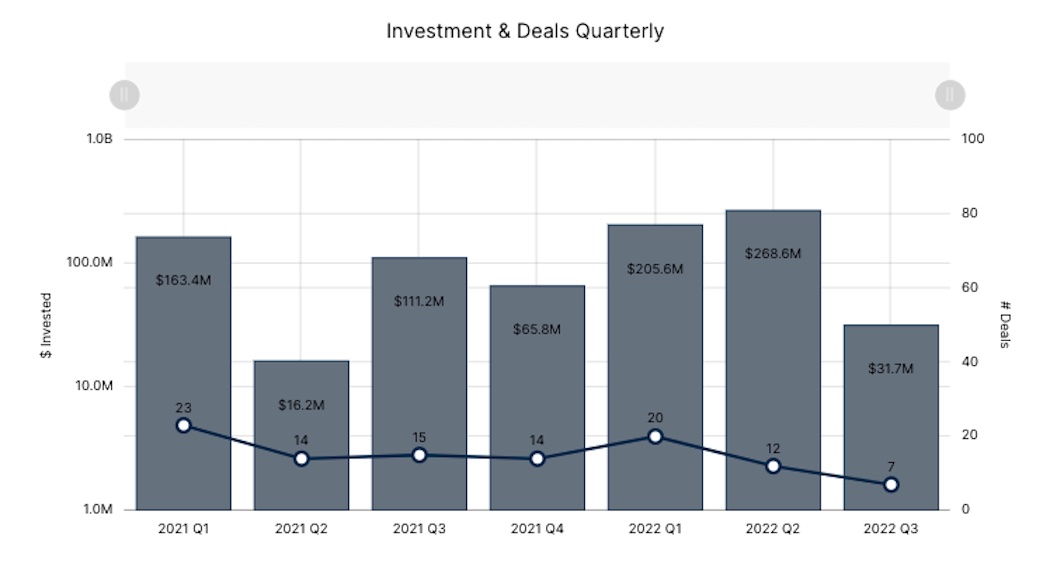

With a total of $31.7 million raised during Q3 2022, venture funding in Alberta declined by 88 percent from Q2 2022, a 71 percent drop from the third quarter of 2021. Q3 2022 represented the lowest funding quarter for Alberta since Q2 2021, when only $16.2 million was raised.

With only seven deals total tracked by briefed.in, the third quarter of 2022 was also the least active quarter for Alberta since the first quarter of 2020. Deal volume fell by 42 percent from last quarter and 53 percent year-over-year.

“The 2008 downturn spurred growth for some incredible companies globally, so there is hope that this downturn will bring the same.”

The decline in venture funding was a result some members of the Alberta tech ecosystem anticipated. Commenting on the province’s record-setting Q2 2022, Tiffany Linke-Boyko, Edmonton-based principal at Flying Fish Partners, told BetaKit she expected Alberta would not be immune from the nationwide cooling in investment that began for most ecosystems in Q2 2022.

“Over the last 12 months, we have seen dramatic changes within the broader markets, ongoing challenges with the supply chain, record inflation, and global political upheaval,” Linke-Boyko told BetaKit more recently. “All of this is impacting the approach and pace that deals are being done.”

James Lochrie, managing partner of Calgary-based Thin Air Labs, told BetaKit he believes the decline in venture funding is in line with the general slowdown in global venture deals and that valuations in the province have generally reset to pre-pandemic levels, a trend he considers to be healthy.

One factor that contributed to Alberta’s lower venture funding performance in the third quarter was the absence of late-stage deals. In the second quarter of 2022, Alberta was unique among other Canadian ecosystems, setting a new quarterly record for venture funding while other ecosystems saw downturns. One deal that contributed to that record-setting quarter was Neo Financial’s $185 million Series C megadeal.

In Q3 2022, briefed.in tracked zero deals above the Series A stage in Alberta. With the largest investment of the quarter being a $13 million Series A funding round led by Aurora Hydrogen, Alberta also saw no deals reach nine figures in the third quarter.

Linke-Boyko said that it’s important to keep in mind that Alberta is a young tech ecosystem, which generally has fewer companies at the later stages of growth; the proportion of late-stage megadeals is expected to be much lower than in other regions in Canada, such as Toronto (notably, Toronto also did not see any megadeals in Q3 2022). Linke-Boyko said that broader changes in the economy and markets are also impacting fundraising at this stage.

“Investors were taking their time to see what was going to happen in the broader economy and markets,” she added. “This means that if you were a company that was planning to start fundraising in Q3, you might have reconsidered and tried to delay it or looked at a bridge round rather than a full Series B [or higher].”

Although venture funding in Alberta dropped off in the third quarter, the province has performed exceptionally well from an annual perspective, thanks to a strong H1. So far in 2022, Alberta tech startups have raised a cumulative $505.9 million, already surpassing 2019, 2020, and 2021 in terms of investment dollars by 200 percent, 65 percent, and 41 percent, respectively. Lochrie said given the relatively small market in Alberta, he expects to see upswings and downswings from quarter to quarter, but noted the trend in Alberta is generally upwards.

“There is still a stockpile of dry powder waiting to be invested, but the investment timeline has slowed, and valuations have changed while expectations of reaching milestones have increased,” Linke-Boyko added. “This is a powerful mixture of positive energy and potentially impactful challenges for companies.”

Decline in seed-stage deals not a cause for concern…yet

According to briefed.in, Alberta saw a total of three pre-seed deals, one seed deal, and two Series A deals in the third quarter of 2022 (one deal, raised by Calgary-based ZayZoon, was not classified under a certain stage ).

While early and mid-stage activity comprised the vast majority of deal flow in Q3, the province still saw a 75 percent quarterly decline in seed-stage deals in Q3 2022. The third quarter of 2022 is tied with Q1 2019 for the lowest on record for seed-stage deals for Alberta in at least the last three years.

Lochrie said that from his vantage point, Alberta’s seed-stage ecosystem is more robust than ever, and he believes the current metrics for deal flow are not representative of what is happening on the ground. “Alberta has a strong angel investment culture and I believe a lot of the seed deals are not reported in the VC numbers,” he added.

It’s true that pre-seed and seed-stage deals often go unreported and briefed.in collects data either from companies that self-report deals or from public, online sources. Linke-Boyko added that because current changes are largely being driven by broader market upheaval and unknowns, “there is no need for concern yet” about Alberta’s early-stage ecosystem.

Provincial politics

As the tides of the broader economy have changed in recent months, so too have the politics in Alberta. This month, newly-elected premier Danielle Smith selected Nate Glubish as minister of technology and innovation was an apparent signal that her government would continue to invest in the province’s innovation sector.

While innovation appears to remain a priority for Smith, the first few weeks of her leadership resulted in some tension between the government and the local tech sector. This month, a number of Alberta tech firms penned an open letter to the premier over concerns that a professional standards body is dissuading workers from locating to the province.

The signatories specifically objected to the “aggressive position” the Association of Professional Engineers and Geoscientists of Alberta (APEGA) has taken regarding the title of software engineer. The petitioners described legal action the APEGA recently took against local tech companies like Jobber and the restriction it places upon tech companies hiring software engineers as an “existential threat.”

Recent concerns from the sector stand in contrast to the optimistic atmosphere of Alberta’s tech ecosystem just five months ago, before Smith was elected. While these issues no doubt touch Alberta’s tech companies and employees, Lochrie and Linke-Boyko are both doubtful they would have a meaningful impact on Alberta venture funding, with Lochrie describing these recent tensions as “non-issues for founders and funders.”

“There are always ongoing political challenges and conversations, yet venture capital continues to focus on companies, the teams building them, and specific market opportunities,” Linke-Boyko added. “Our hope is that politicians foster an environment that helps companies scale.”

Getting back to basics

Even as investors grow more cautious in Alberta, Lochrie indicated that there is still a great deal of optimism in the province, and local companies are continuing to attract global attention. “It is widely believed that Calgary will become the second largest tech center in Canada outside of Toronto,” he added.

Linke-Boyko believes the short-term deceleration of activity offers founders an opportunity to “get back to basics,” which means building earlier relationships with VCs that are a good fit and getting a no-nonsense grasp on company finances.

“There is general agreement that there will likely be challenging times in the next 12 to 24 months, but also, there are discussions about which companies will successfully emerge,” she added. “The 2008 downturn spurred growth for some incredible companies globally, so there is hope that this downturn will bring the same.”

briefed.in is owned and operated by Communitech. BetaKit receives data from briefed.in as part of a media partnership with Communitech and retains full editorial control of all articles that reference the data produced by briefed.in/Communitech.

.