Global oil company Exxon Mobil (XOM) gapped lower Friday as crude oil futures sank around 6%. Not pretty but the rising 200-day moving average line is not far below the market. Is this a buying opportunity or a sign that “everything is up for sale”?

Let’s check.

In this daily bar chart of XOM, below, we can see that the price of XOM has largely moved sideways the past four months. The longer-term trend is up as XOM is still above the rising 200-day moving average line which intersects around $84.

Previous tests of the 200-day line back in November and December were a buying opportunity but the various moving parts – oil prices, interest rates, the dollar – have all changed significantly. The trading volume has been declining since the middle of June and suggests that investor interest has moved elsewhere.

The On-Balance-Volume (OBV) line shows a slight decline from early June as sellers of XOM appear to be more aggressive than buyers. The Moving Average Convergence Divergence (MACD) oscillator is crossing the zero line for an outright sell signal.

In this weekly Japanese candlestick chart of XOM, below, we can imagine that prices are testing the rising 40-week moving average (this website does not update its weekly candlestick charts until Friday’s close).

We can see that weekly trading volume has been shrinking in recent months while the weekly OBV line looks like it is topping. The MACD oscillator has been weakening since June.

In this daily Point and Figure chart of XOM, below, we can see a potential downside price target in the $72 area.

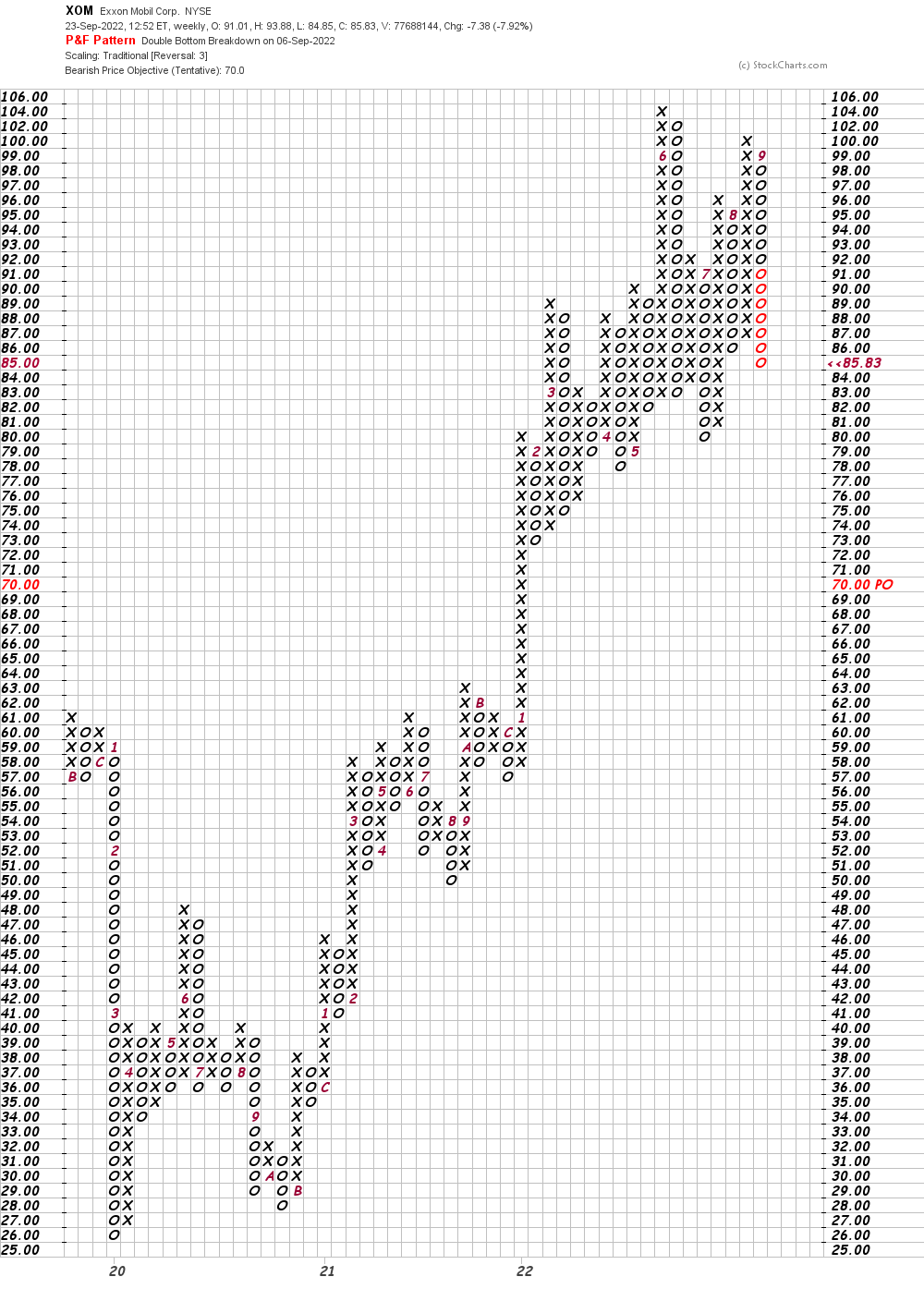

In this weekly Point and Figure chart of XOM, below, we can see a price objective in the $70 area.

Bottom line strategy: XOM and other energy names have been a sector to hide out in during the 2022 bear market. New lows for the move down in crude oil futures could generate further long liquidation in energy names despite longer-term bullish trends. In this current period of broad market weakness it may be better to do some selling and ask questions later.

Get an email alert each time I write an article for Real Money. Click the “+Follow” next to my byline to this article.

.