Sundry Photography

Rakuten’s (OTCPK:RKUNY) strong ecosystem of users and merchants in Japan remains its key asset, but recent quarterly results have been far from positive. Its Q2 2022 results were heavily in the red – in contrast to the internet services and fintech businesses, which are outperforming, the mobile venture loss was the key drag as capex growth was accompanied by subscriber declines. While Rakuten’s mobile network service (launched in April 2020) holds promise given its high-quality “cloud native” network design, the unclear path to breakeven remains the key hurdle. Even though the stock price popped on the earnings report, likely in reaction to its e-commerce strength and signs of slowing mobile losses, the outlook remains very challenging, in my view. Given the tough subscriber acquisition battle ahead for the company to achieve mobile breakeven and the still uncertain subscriber acquisition cost to get there, I would hold off on underwriting an upside scenario from here.

Mobile Weakness Remains a Drag on Overall Results

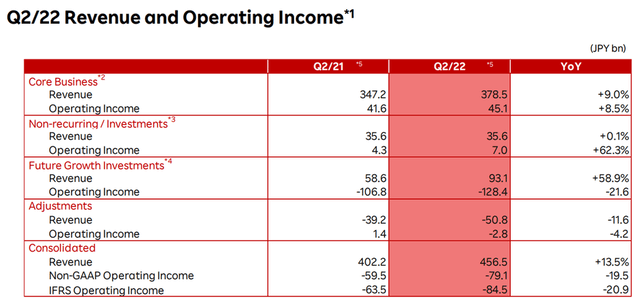

Rakuten reported Q2 revenue growth of ~14% YoY but a wider operating loss at -JPY84.5bn (-21% YoY) and a loss per share of -JPY54. Unsurprisingly, the key drag was the mobile business, which saw a net ~220k drop in subscribers (comprising -140k from mobile network operators subs (MNOs) and -80k mobile virtual network operators (MVNOs)). The silver lining was that users of 1G or less of free data accounted for the vast majority (~80%) of the drop, implying a continued net increase in paying users through the quarter. Still, the mobile business’ JPY124bn loss (a deterioration from the loss level a year earlier but a modest improvement QoQ) is worrying.

Rakuten

In the meantime, Rakuten Travel has been the star performer in domestic e-commerce. The segment saw gross merchandise sales growth of ~12% YoY as the Rakuten Travel business recovered to pre-COVID levels. Similarly, the FinTech card shopping business was strong as well – gross transaction value increased by an impressive ~29% YoY amid a recovery in offline consumption, while Rakuten Cards issued reached 26.7m. All in all, if we were to exclude mobile, Rakuten’s non-GAAP operating income would have risen by a solid ~13% YoY. The cash flow is a concern, though, as the non-financial business saw its H1 2022 FCF deficit widen to ~JPY460bn. Coupled with the below consensus mobile operating loss and the lack of any new financial measures to mitigate the significant FCF deficit, I am concerned about Rakuten’s balance sheet position going forward.

Mobile Overhang Weighs on Near-Term Guidance

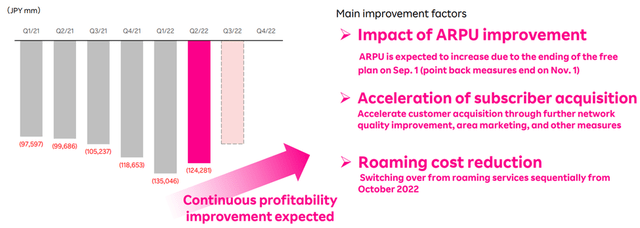

In the near term, there remains little respite from continued losses in the mobile business – mobile capex has already reached JPY89bn, and borrowings have increased in tandem to JPY763bn. Management reiterated its plans to get to monthly breakeven at some point in 2023, though, helped by declining roaming costs (note the next reduction is due in October). Scale remains key to sustainable profitability – assuming the network hits higher penetration, fixed costs can be spread over a much larger subscriber base, boosting the bottom line. The issue is that subscriber growth has been underwhelming, and thus, it is difficult to underwrite a turnaround scenario at this juncture.

Rakuten

Still, management’s defense of the company’s mobile strategy inspires confidence. Of note, calls for lower churn, lower domestic roaming costs, and the potential to ramp up revenues are steps in the right direction. These churn and revenue projections, however, hinge on the full elimination of the free 1GB offer in H2 2022, and given the subscriber decline this quarter, I would be hesitant to pencil in these numbers. The rest of the business (eg, e-commerce and fintech) are clearly outperforming and should drive a further QoQ improvement in Q3 (in line with guidance). Heading into H2 2022, the current guidance also calls for continued single-digit growth in gross merchandise value and improved ad sales, as well as first-party business profitability (mainly due to the recent traction in online supermarket Net Super after initial losses). The group’s ~JPY100bn operating loss target in the upcoming quarter seems realistic but given its rather ambitious target to deliver a monthly profit by end-2023 is unchanged, I am concerned that more downward revisions could be on the horizon.

Planned Asset Spinoffs a Sign of Things to Come

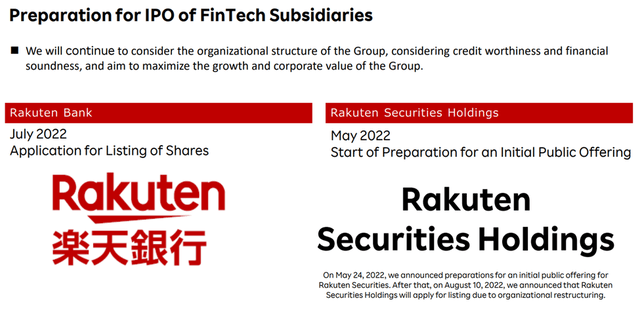

Leading up to earnings, Rakuten had applied for permission to separately list its subsidiary Rakuten Bank on the Tokyo Stock Exchange (TSE). The announcement came as no surprise, given Rakuten has been vocal about its aim to list around December 2022 (leaving a few months for pre-listing reviews to complete). Approval hurdles are unlikely, in my view – financial statements for the banking unit have been prepared and disclosed under regulatory supervision for a while now, so this should be a straightforward process.

Rakuten

The valuation is the key concern, though, particularly in the current market environment (note that Japanese bank assets tend to command a net asset ratio-based valuation). On the flip side, a successful listing of Rakuten Bank and Rakuten Securities should strengthen the balance sheet and partially fund the growing capital needs of the mobile unit without incurring shareholder dilution. For context, the group has been funding its ongoing investment needs (mainly network construction) via a range of dilutive corporate exercises, including a JPY242bn share issuance in March 2021 and $1.75bn and EUR1bn of undated subordinated notes issuances in April 2021.

Mobile Remains the Key Hurdle

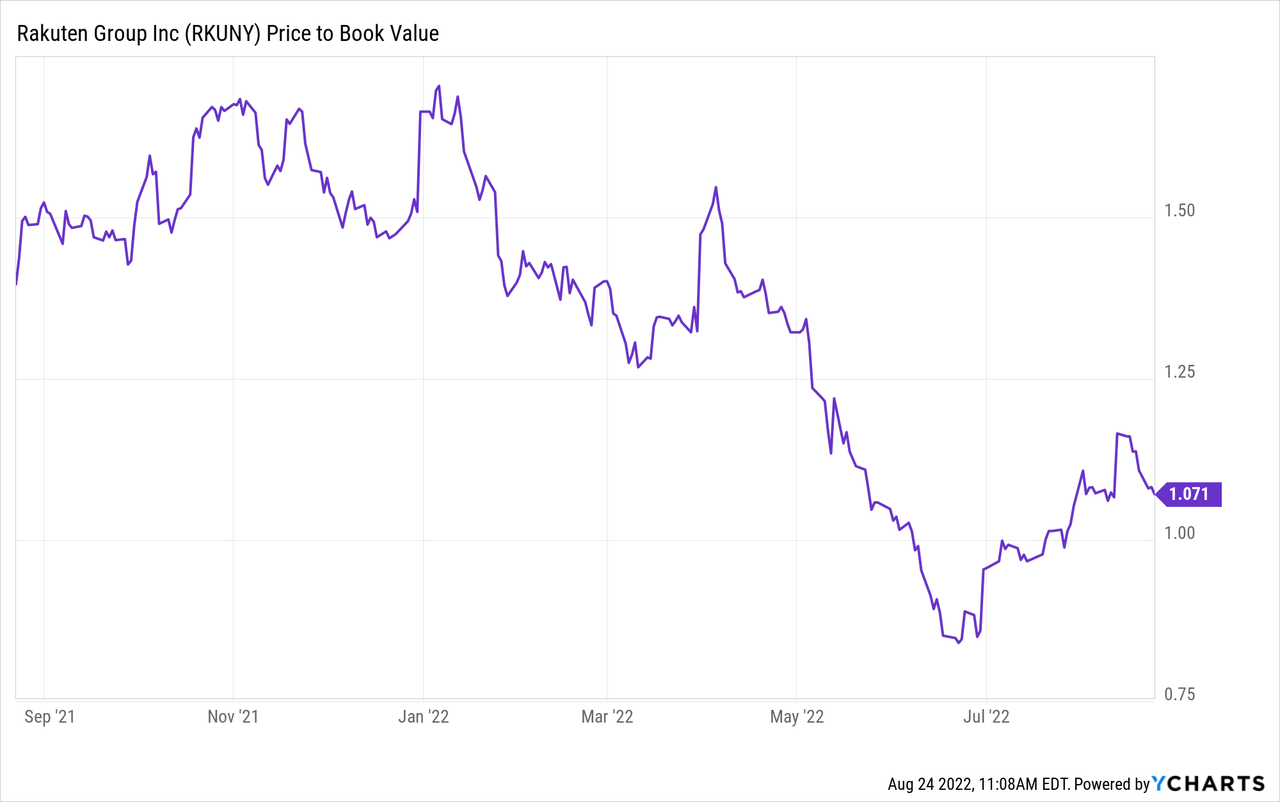

Rakuten’s financial results continue to benefit from its leadership in e-commerce, which looks set to be the winning retail channel over the long term. That said, its recent expansion into the telecom industry adds significant uncertainty to the investment case. The mobile strategy could ultimately prove to be the right call – Rakuten’s technological leadership with Open RAN and continuously improving network quality, as well as its wide distribution reach in Japan, are all positive signs. That said, the company is spending a significant amount to break into the market as Japan’s fourth mobile carrier. The latest ~JPY124bn loss in mobile, for instance, highlights the venture is a long way from breakeven, and concerns about what level of subscriber base it can achieve (and at what ARPU) remain top of mind. With the stock also trading at a premium to book, I would remain on the sidelines for now.