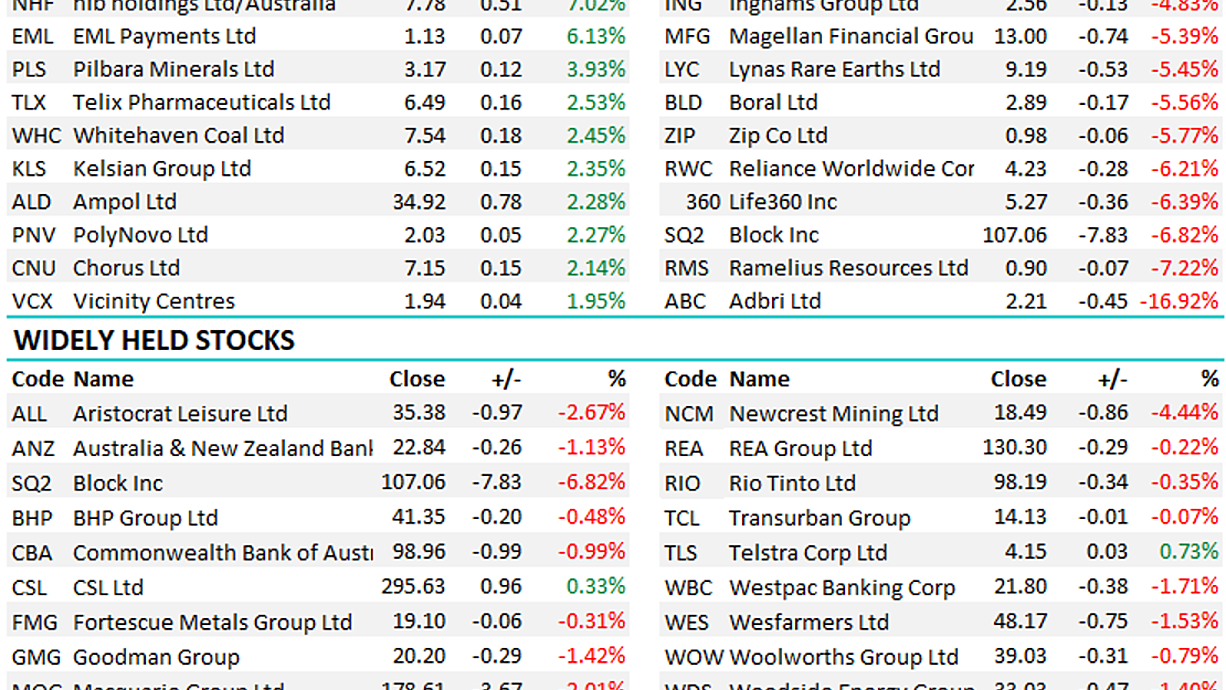

It was a soft session to kick off the new trading week with all sectors finishing lower, although a big variance in the magnitude of moves. As of this morning, 58% of the market had reported results and so far, they have been better than feared with the beat-to-miss ratio running at 3:2, however, the big test comes this week with more domestically focused consumers stocks out with numbers.

- The ASX 200 finished down -67pts/ -0.95% at 7046

- The Healthcare sector was the best relative performer (-0.02%) while Communications (-0.21%) & Utilities (-0.40%) outperformed a weak market.

- Consumer Discretionary (-1.94%) and IT (-1.48%) the weakest links.

- Adbri (ABC) -16.92% fell the most in 2 years as 1H earnings missed and they reduced the interim dividend.

- EML Payments ASX:EML + 6.13% rallied after reporting decent top-line growth and launching a (small) $20m on market buyback.

- oOh!media ASX:OML +8.5% lifted earnings by 62% and announced an on-market share buyback.

- NIB ASX:NHF +7.02% was strong on good FY22 and strong guidance for FY23 – insurers have been the big beaters this reporting period so far.

- Audinate ASX:AD8 -3.61% fell given their FY22 result was largely pre-announced on 28 July 2022 when they upgraded however we got some more color on their FY23 outlook.

- Reliance Worldwide ASX:RWC -6.21% down as much as 10% at its worst today on a result that looked at least in line with expectations. The uncertain outlook the worry.

- Lend Lease ASX:LLC +0.10%: delivered a big 2H to meet FY numbers however as is fairly customary in recent times, they now say FY24 will be their year where things really come together,

- Adairs ASX:ADH -13.73% posted a disappointing FY22 result today and soft guidance for the year ahead.

- Nick Scali ASX:NCK +5% with revenue up 18% YoY thanks to the Plush acquisition, although revenue fell in the core Scali business.

- Iron Ore was ~1.5% higher in Asia today

- Gold was down to ~US$1740/oz at our close.

- Asian stocks were mixed Hong Kong down -0.3%, Japan Nikkei -0.76% while China was up +0.60%

- US Futures are all lower, down around -0.60%

ASX 200 chart

Audinate (AD8) $8.80

AD8 -3.61%: FY22 result was largely pre-announced on 28 July 2022 when they upgraded however we got some more color on their FY23 outlook for (1) Video to start ramping up delivering >US$3m in revenues; and (2) existing headcount of 178 could deliver 2x revenues in the medium term. Overall, revenue was up 33% for the year to $46.3m with EBITDA +41% to $4.3m, which was the top end of their previously guided range. They did report a net loss for the year of $4.5m which was a negative surprise. All in all, a decent result from a company that has run strongly in the last few months.

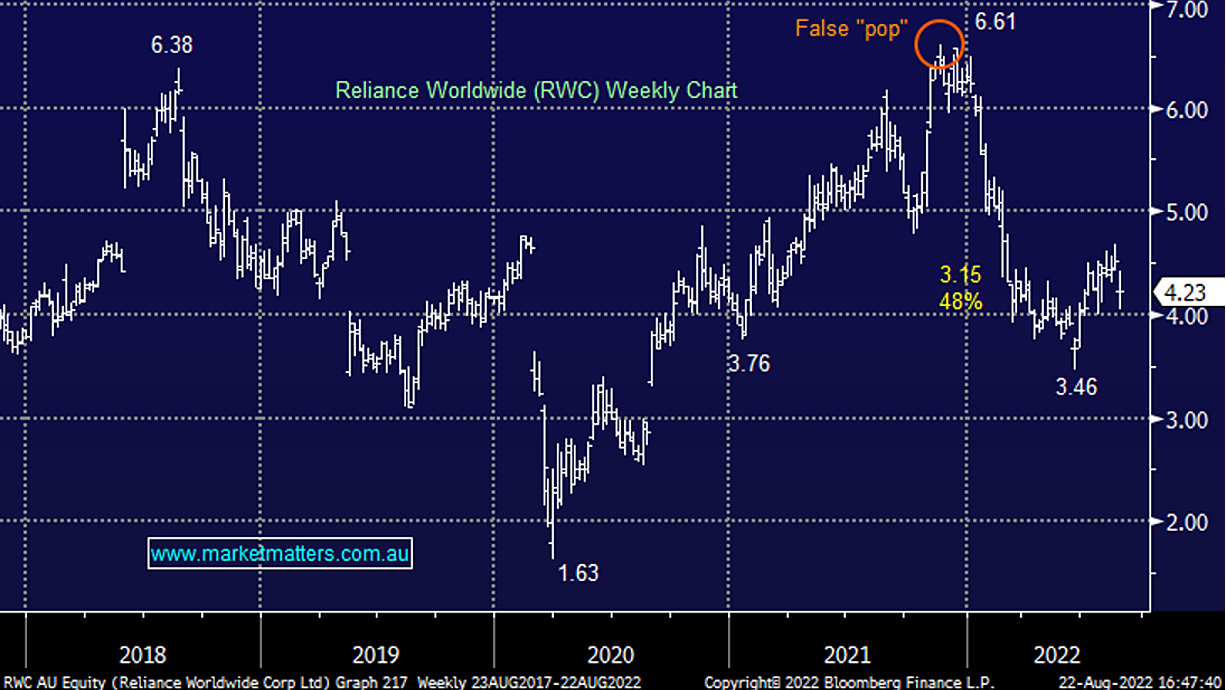

Reliance Worldwide (RWC) $4.23

RWC -6.21%: The supplier of plumbing parts was down as much as 10% at its worst today on a result that looked at least in line with expectations. Net sales of $US1.17bn were online with consensus while adjusted net profit of $137.4m was 2% lower than FY21 but in line with the $138m expected. They said that while the short-term outlook is “satisfactory” the medium-term outlook is uncertain, although we think that RWC’s focus on repairs should position better than others through any downturn. One obvious risk is the destocking from wholesalers who bought up big at the end of FY22 due to supply chain issues and that should have a negative impact at the start of FY23. They also talked about higher commodity costs for key materials including copper, zinc, resins, and steel, along with freight, packaging, energy and other cost inflation. They said average price increases across the group of about 9.5% were achieved during the period, with price increases implemented in all key markets helping to offset cost increases. That has been an obvious theme throughout this reporting season where consumers have (so far) handled higher prices.

Lendlease (LLC) $10.41

LLC +0.10%: Back in April, LLC talked to a big 2H and they’ve delivered ‘sort of’, however as is fairly customary in recent times, they now say FY24 will be their year where things really come together, and they do seem to be on the right track. FY22 corporate operating profit after tax of $276m was ahead of expectations which flowed through to a better earnings per share (EPS) result of 40.1cps v 36.1 expected and a dividend of 16cps. LLC results are always difficult to decipher, so many moving parts and they are a business on the improve, looking at their return on equity figure of 4% shows they certainly need to!

Adairs (ADH) $2.20

ADH -13.73%: the homewares retailer posted a disappointing FY22 result today, and soft guidance for the year ahead further weighed on shares. Revenue was in line, however, EBIT and Net Profit missed consensus by around 3%. Costs were higher in the period due to COVID lockdowns, supply chain issues and additional investments meant that profit fell ~30% despite sales growth of 13%. Most of the increase in costs will roll off for FY23, however, guidance was also below expectations. The market was slightly above the $75-85m EBIT guidance the company provided for the current period.

Adbri (ABC) $2.21

ABC -16.92%: a first-half report for the construction products company today was impacted by a range of issues with shares falling heavily as a result. Underlying EBIT fell -7% year on year as cost pressures and weather impacted margins. The company said demand remains strong across each of the sectors and price hikes are being pushed through to regain margins however the cement volumes will be impacted by longer completion periods as the construction sector faces labor and materials shortages. Earnings are expected to grow in the 2H, although it is highly doubtful that the company will reach consensus numbers.

EML Payments (EML) $1.125

EML +6.13%: FY22 results today showed better than expected top-line growth but a challenging year from a remediation/cost perspective. This is not a bad result given ~60% of their business is in Europe, which is experiencing some big macro headwinds. Revenue from ordinary activities came in at $232.4m, a touch ahead of $230.5m expected while underlying EBITDA of $51.2m was a beat to $48m consensus. They launched a relatively small on-market share buy-back program of up to $20 million and said cash was sitting at $73.7m. The question being, has peak pessimism past for EML and is there more corporate interest out there – we suspect there is.

Broker moves

- Stockland Raised to Neutral at Jarden Securities; PT A$4

- IGO Cut to Hold at Canaccord; PT A$13.25

- Core Lithium Cut to Hold at Canaccord; PT A$1.50

- Cochlear Cut to Underperform at Macquarie; PT A$194

- HT&E Cut to Neutral at Macquarie; PT A$1.40

- Home Consortium Rated New Neutral at Macquarie; PT A$5.25

- Nuix Cut to Equal-Weight at Morgan Stanley

- Amcor GDRs Cut to Neutral at UBS; PT A$19.40

- AGL Energy Cut to Neutral at Credit Suisse; PT A$8.20

- Lynas Cut to Neutral at Macquarie

- Stockland Cut to Neutral at Citi; PT A$3.96

- TPG Telecom Cut to Hold at Jefferies; PT A$6.11

- Pact Group Cut to Neutral at JPMorgan; PT A$2.20

- Accent Group Raised to Add at Morgans Financial Limited; PT A$2

- Cochlear Cut to Neutral at Citi; PT A$225

- PWR Holdings Cut to Hold at Bell Potter; PT A$9.75

- Bank of Queensland Cut to Underperform at Jefferies; PT A$5.70

Major movers today

Have a great night,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market closes. Follow my profile to be notified when the latest report is live.

.