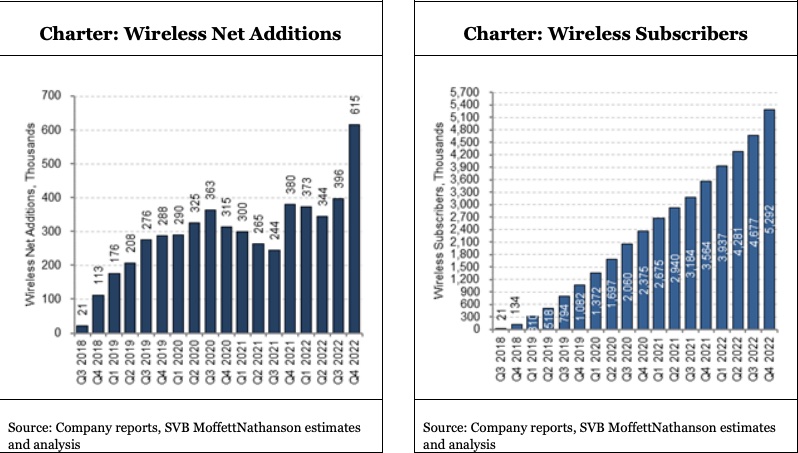

Charter Communications’ 4-year-old consumer wireless business Spectrum Mobile reported a record gain of 615,000 subscriber lines in the fourth quarter.

Touting 5,292 million total lines as of Dec. 31, Spectrum Mobile’s girth has closed to within just a hair shy of the 5.31 million lines reported by Comcast Thursday during its Q4 earnings call. For its part, Comcast also touted a record growth quarter for Xfinity Mobile by adding 365,000 service lines.

Also read: Charter Q4 Earnings Fall Despite Gain of 92,000 Internet Subscribers

Notably, Xfinity Mobile beat Spectrum Mobile to market by about 14 months, launching in April 2017. Comcast and Charter both base their mobile platforms on mobile virtual network operator (MVNO) arrangements to use Verizon’s national wireless network, offloading much of the traffic to their respective Wi-Fi networks. The cable operators also collaborate heavily on back-office operations for their mobile services.

For both Comcast and Charter, these efforts have paid off with businesses that are now generating meaningful sales.

According to analyst Craig Moffett, Spectrum Mobile has grown to account for 6.4% of Charter’s Q4 revenue. (For all of 2022, Charter generated $54 billion in revenue, up 4.5% year over year. You can read the full earnings release here (opens in new tab).)

“The growth in wireless is more than offsetting the declines in video and wired voice,” Moffett said in an investor note published Friday shortly after Charter’s earnings call.

Charter’s spike in Q4 wireless growth coincides with the launch of its new “Spectrum One” services bundle, with the No. 2 US cable operator now packaging home internet services featuring its “Advanced Wi-Fi” product with a single Spectrum One mobile line for a starting price of $49.99.

With Altice USA also in the US wireless business since September 2019, US cable companies controlled 31% of domestic wireless customer additions in the third quarter.

Cable’s market share seems likely to further increase in 2023. Cox Communications is making yet another attempt in the wireless business. Mediacom just trademarked the name “Mediacom Mobile.” And the National Content & Technology Cooperative is now talking to its Tier 3 membership about MVNO deals, too.

The ascendency of cable in a US wireless business controlled by T-Mobile, Verizon and AT&T comes as the latter constituency begins to seriously eat into MSO’s control of wireline broadband.

Earlier this week, Verizon reported a quarterly record of 379,000 customer additions for its Verizon Home Internet 5G fixed wireless access product. T-Mobile will likely tout similarly impressive FWA gains next week during its Q4 earnings report.

This growth comes as No. 1 US cable operator and broadband provider has seen its once explosively growing wireline internet business enter a narrow recession, losing 26 million customers in Q4.

For its part, Charter added 105,000 high-speed internet customers across residential and business channels.